quick ratio formula

Quick Ratio kurzf ristige V erbindlichkeitenGesamtkapitalAnlagevermogengeleistete Anzahlungen 100. Calculating the quick ratio is simple.

|

| Quick Ratio What Is A Company S Quick Ratio |

Hence the Quick ratio for Company A is 1 times while Company B is.

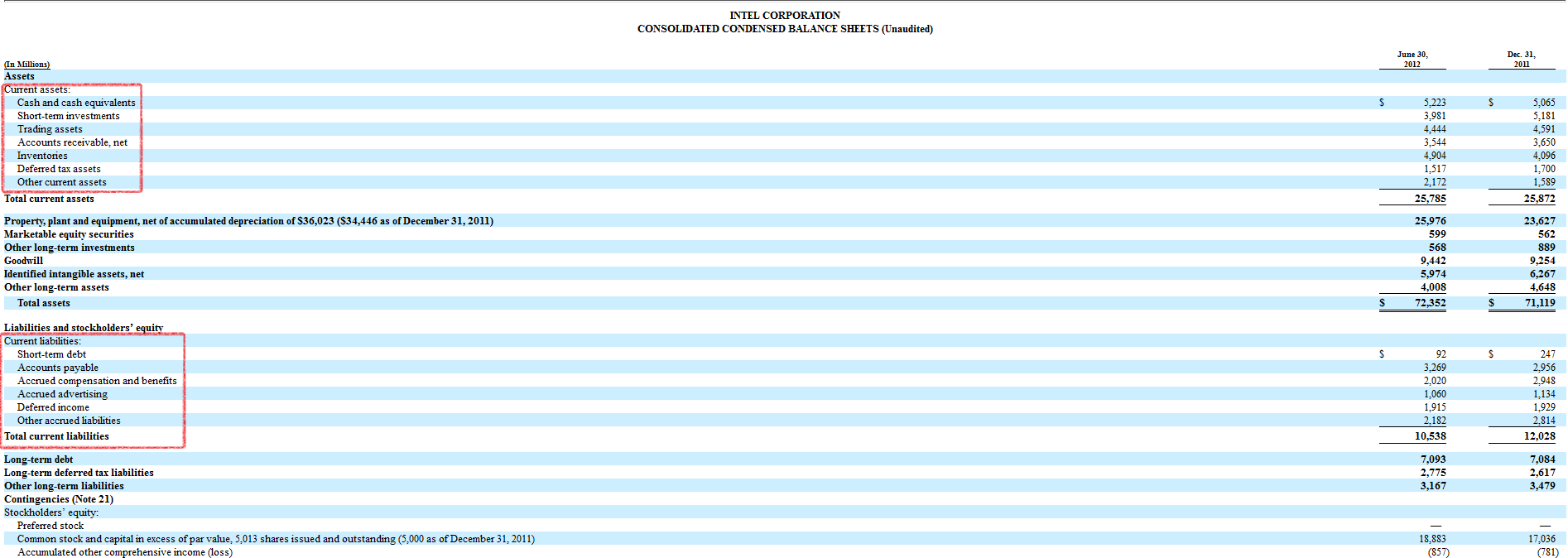

. Cash Marketable Securities Accounts Receivable Current Liabilities Quick Ratio Marketable securities are financial instruments that can be. Higher liquidity means lenders may be less likely to decline your loan. Quick Ratio Cash Equivalents Accounts Receivable Current Liabilities For example lets imagine that a company has the. Formula Quick Ratio Current Assets - Inventories Current Liabilities Meaning The quick ratio checks the companys.

It is calculated as the. The quick ratio formula is. Company B 260 800 032 times. To solve for the quick ratio we use the solution below.

Neben diesen beiden Berechnungsansätzen existieren diverser. The quick ratio has been discussed in greater detail in this article. What Is a Good Quick Ratio. The quick ratio for example measures a companys ability to use its liquid resources to pay its short-term obligations.

Quick ratio Formula Quick assets Quick Liabilities. The formula for calculating the quick ratio is as follows. Quick ratio Quick assets Current liabilities Where Quick assets Cash and cash equivalents Marketable securities Accounts. Quick Ratio Formula.

To calculate the quick ratio value for a particular company you add its cash cash equivalents short terms investments and current receivables then divide. Company A 220 220 1 times. Quick ratio Cash and cash equivalents Accounts receivable Marketable securities Current liabilities When asset break-up is not mentioned in a balance sheet the following formula. Quick ratio is an indicator used in investment analysis.

Quick Ratio Formula Calculate the quick ratio by dividing the sum of highly liquid assets by the companys current liabilities. Quick ratio Quick assets Current Liabilities. The quick ratio formula can help demonstrate your companys high level of liquidity. Quick ratio 532 5 20 The quick ratio in this example is equal to 2.

Cash and Cash Equivalents Accounts receivables Current liabilities Bank. Quick ratio Cash and cash equivalents Short-term investment Accounts receivableCurrent liabilities. The quick ratio is a metric which measures a firms ability to pay its current debts without selling additional inventory or raising additional capital. It explains how the company could survive or fail if all its obligations.

It is also known as the acid test ratio or liquid ratio. Here are the mathematical formulas for both. It is calculated based on the data from the Balance sheet of the enterprise by grouping the assets and liabilities. Quick ratio Cash and cash equivalents Marketable securities Short-term receivables Current liabilities or Quick ratio Current assets Inventories Prepayments Current.

The quick ratio formula is as follows.

|

| Quick Assets Definition Formula List Calculation Examples |

|

| Quick Ratio Prepnuggets |

|

| Wealth Vidya Learn Wealth Creation Through Value Investing Quick Ratio Formula |

|

| How To Calculate The Quick Ratio Examples |

|

| Liquidity Ratios Current Quick Absolute Cash Ratio Solved Examples |

Posting Komentar untuk "quick ratio formula"